The States with the Most and Least BIPOC-owned Small Businesses

May 19, 2021

It’s hard to overstate the importance of small businesses. These nurturers of creative opportunity, community, and local economy add more than just options for shoppers—and may even encourage property development and home-buying in underfunded, underutilized areas. When it comes to having a robust network of small businesses in your area, the benefits really aren’t so small at all.

And yet, small businesses shuttered by the thousands at the height of the Covid-19 pandemic, due in part to their reliance on in-person shoppers. With store closures and shelter-in-place mandates, many small-business owners thought it better to close permanently rather than risk bankruptcy. While owners and employees worked to weather the last year through creative marketing, flexible services, and dedicated customers, some were more vulnerable than others.

Even without the stormy conditions created by an unprecedented global virus, minority-owned small businesses face structural and societal challenges to their viability and success. Limited access to credit, less start-up capital, and a concentration of BIPOC business ownership in the service and retail industries make for precarious business health. Shopping local and small may be more important now than ever before in order to help restore the small-business economy to its pre-pandemic output, but also to protect the diversity of those businesses and their ownership. But which states have significant numbers of thriving minority-owned small businesses, and which states don’t?

Methodology

To find out, we turned to the Small Business Administration’s small business profiles to develop a snapshot of BIPOC small-business ownership across the country. We analyzed the number of BIPOC-owned small businesses, self-employed BIPOC men and women, and BIPOC state residents to determine which states had the highest and lowest percentages of each as compared to overall small businesses, small-business owners, and state population.

Read on for our results!

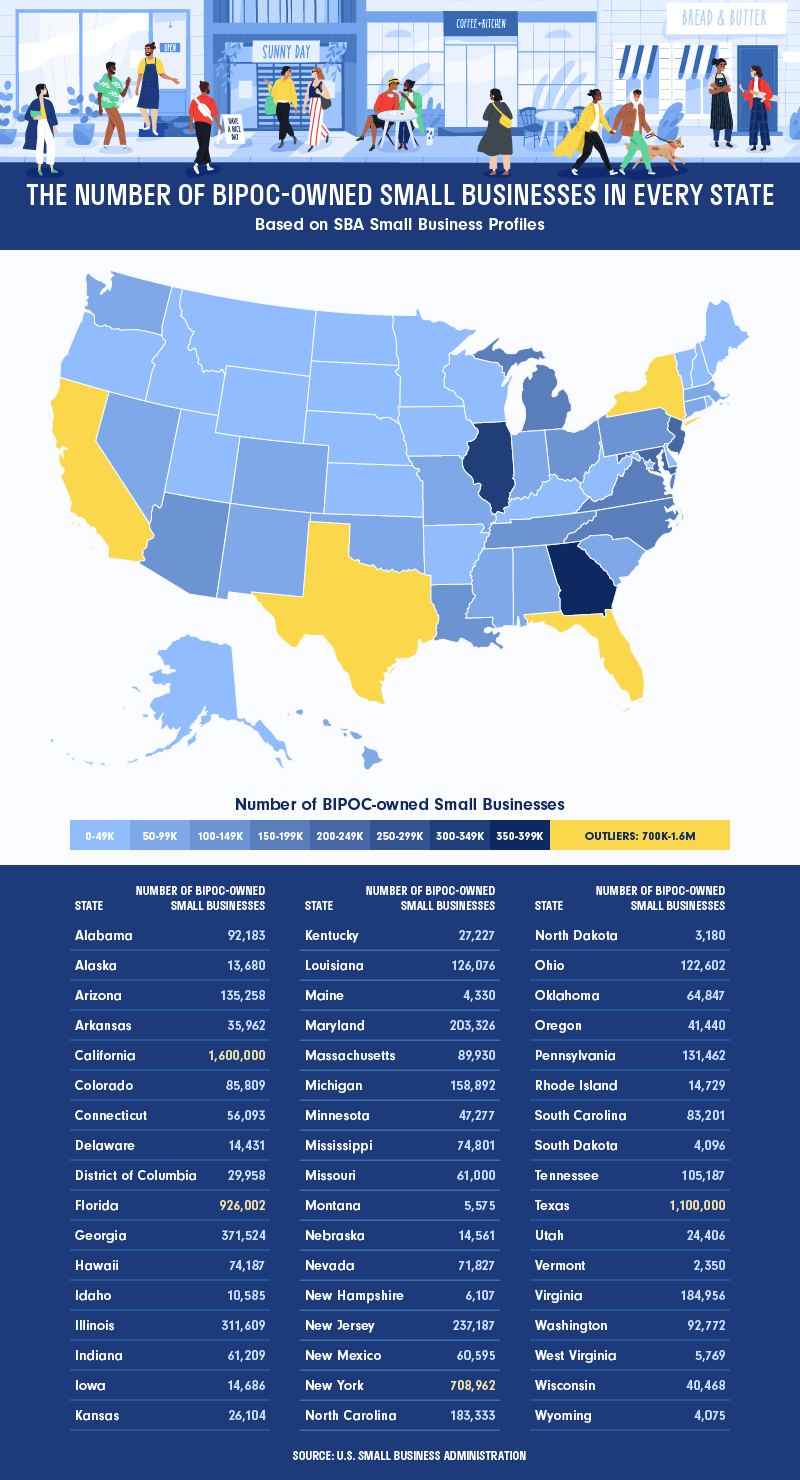

BIPOC-owned Small Businesses Across the United States

Across the United States, minority small business ownership is as varied in count as we can assume it is in business type and services. Total numbers of BIPOC-owned small businesses in every state ranged from the millions in states like Texas, New York, California, and Florida, to the low thousands in Vermont and North Dakota. We can attribute much of these differences to the size of the state populations, as well as the demographics. While 41.6% of the Californian population identifies as BIPOC, only 6.4% of Vermont residents can say the same. In Florida, BIPOC individuals account for over a quarter of the population (25.9%) and BIPOC-owned small businesses are just shy of a million in total, at 926,002.

Some states with fewer BIPOC residents boasted significant numbers of BIPOC-owned small businesses. Colorado, where only 16.7% of the population reported BIPOC identification, is still home to 85,809 BIPOC-owned small businesses. But a larger BIPOC population doesn’t necessarily mean such residents have the resources or feel empowered to take on the challenges of establishing a successful small business. In Arkansas, BIPOC residents constitute 23.5% of the population, but the number of BIPOC-owned small businesses remains comparatively low at 35,962—4,506 fewer than Wisconsin, a state with 8.5% fewer BIPOC residents. While it’s possible that this disparity may speak to structural barriers in southern states for BIPOC entrepreneurs, a deeper dive into the data shows that the count of BIPOC-owned small businesses in each state alone paints only part of the picture.

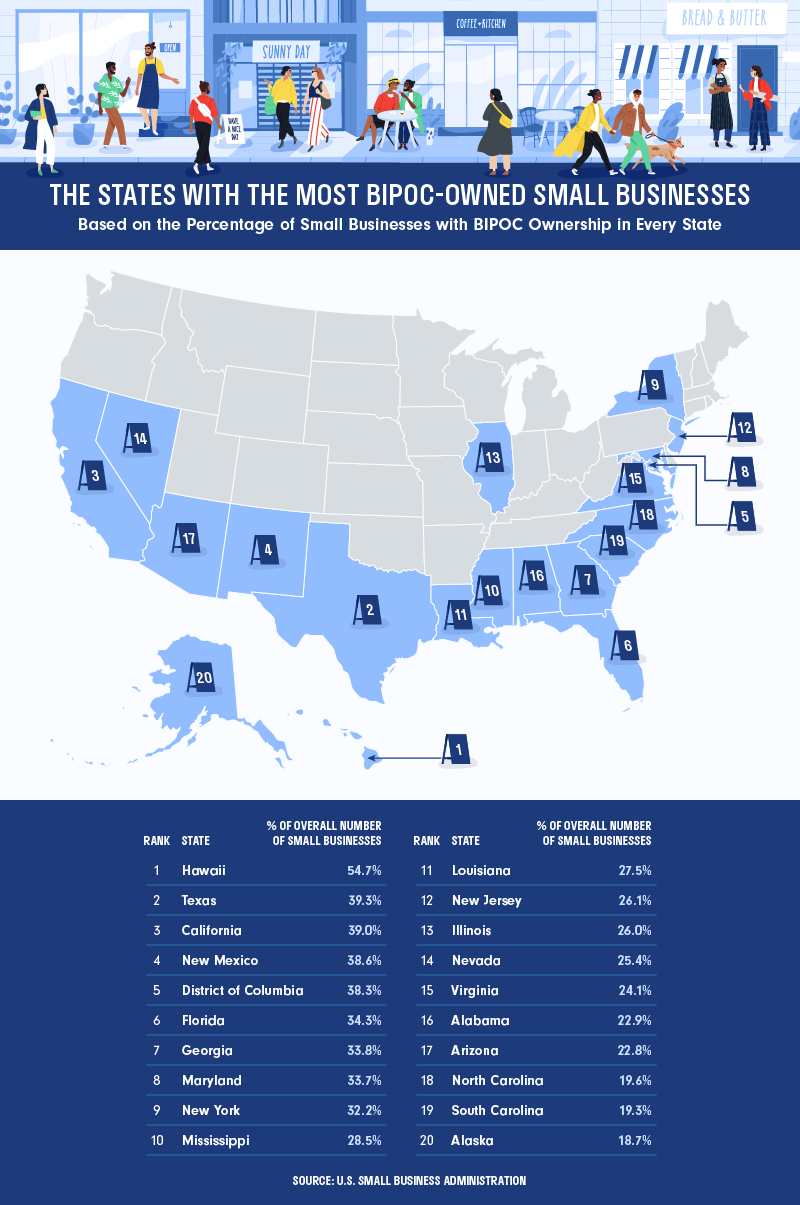

The States with the Most BIPOC-owned Small Businesses

Determining the percentage of small businesses composed of BIPOC-owned endeavors in each state revealed some surprises. Hawaii, which didn’t even make the top 20 states with the highest counts of BIPOC-owned small businesses, filled the number one spot with 54.7%—over 15% more than the next state in the ranking, Texas.

With 91% of the Hawaiian population identifying as people of color, we’re excited to see BIPOC entrepreneurs carving out space for themselves in a state economy dominated by the tourism industry. Over half of Washington, D.C. residents (58%) identify as BIPOC, and the small business owners among them put the nation’s capital in the number five spot, with 38.3%. New Mexico, another state nudged out of the top 20 states with the highest counts of BIPOC-owned small businesses, took the fourth spot in this ranking at 38.6%, only 0.4% behind the highly populous California.

For the most part, the states with the most BIPOC-owned small businesses by percentage form the southern border of the United States. Midwestern representation was limited to Illinois, at 26%, while New England was left off the list entirely.

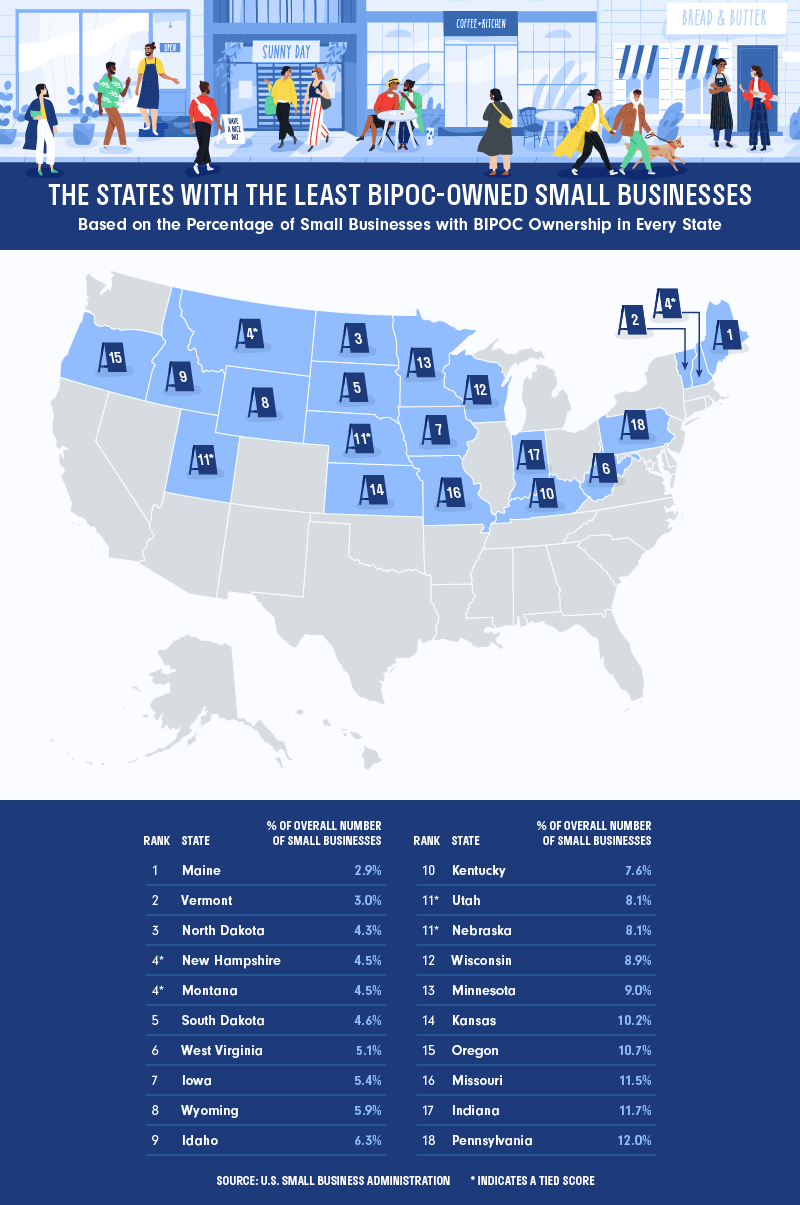

The States with the Least BIPOC-owned Small Businesses

In contrast to the states with the most BIPOC-owned small businesses, those with the least cover much of America’s heartland and northernmost areas. Maine and Vermont, with only 6.4% of each state’s population identifying as nonwhite, ranked first and second among the states with the lowest percentages of BIPOC-owned small businesses. The first six spots remained under 5% BIPOC small business ownership; the last state on the list, Pennsylvania, revealed a meager 12%—6.7% lower than Alaska, the final state in the top 20 states with the most BIPOC-owned small businesses.

Limited BIPOC-owned small business representation in these low-ranking states may be due in part to the lesser diversity of demographics and lower overall populations in many Midwestern and Northeastern states. Still, we don’t yet know the full impact of the Covid-19 pandemic on small businesses across the United States—the small business landscape may have shifted.

Final Thoughts

If there’s one conclusion we can draw from this data, it’s that BIPOC-owned small businesses are as American as apple pie, with representation in all 50 states and the District of Columbia. While minorities face more challenges in establishing and cultivating a successful small business, they remain devoted to investing in communities and economies across the country. It’s our responsibility, both as consumers and community members, to support them with our purchasing power—now more than ever.

If you’re a small-business owner or employee in need of legal advice related to your business or employment, contact the team at Edwards Kirby to learn more about your options. And remember—shop local!

Related Posts

Sep 07, 2023

Apr 13, 2023

We’re Here to Help

Call 919-780-5400 or fill out our online form to request a free consultation. You won’t pay unless we win!